Prices of Apartments in the Czech Republic Have Quadrupled over the Last Twenty Years

Today, there is a great demand for all types of housing on the Czech real estate market, but the number of new development projects is not as large as many of us would like.

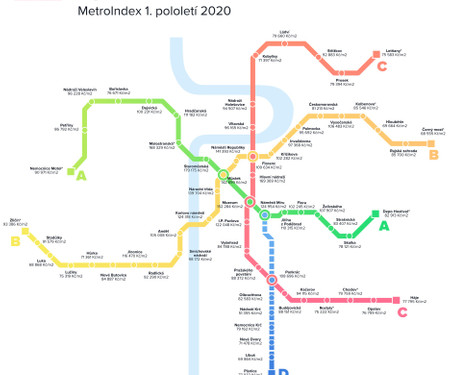

With demand far outstripping supply, and with the Czech economy actively developing and attracting investors from all over the world, property prices are also rising. According to the Czech Statistical Office data, between 1998 and 2020, average house prices in the Czech Republic increased by 4.25 times. The biggest increase was recorded in the Central Bohemian region. There, prices increased by almost 5.25 times on average. It is worth noting that the inflation rate for the same period was only 59.8%.

For more than 20 years, the real estate market has been closely monitored, and now we can mention significant years. In 2003, the active growth of property prices began. After all, investors expected the Czech Republic to join the EU in 2004, which would improve its economic position and open up further opportunities for the country's development. In 2003 there was an increase in foreign investment in the country and house prices doubled compared to 1998. From 2003 to 2008, price growth was around 60%. In 2008, the global economic crisis hit the Czech Republic and triggered a mortgage crisis. This led to an average decrease in property prices of 18.1%. Nevertheless, the crisis was not fatal and in the following years the Czech economy began to return to normal. From 2009 to 2016, annual house price growth was 3.5%. Since 2017, the Czech Republic has seen a steady growth in property values, which is around 10.7% per year. According to the official data of real estate companies, the growth of housing prices in Prague over the last 20 years has averaged 7% per year. Other types of real estate also show positive results. The average price growth of private houses and land has been 4.6% and 5.2% per annum respectively. Investments in real estate have borne fruit, as it is difficult to imagine another financial instrument showing similar results over the same period. Moreover, all this time it has been possible to rent out properties and have a passive income, which has brought investors at least a few extra percent per year.