Rising mortgage rates and tighter conditions in 2022

In the middle of last year, the Czech National Bank began to respond to rising inflation by raising interest rates. Already in December 2021, the base rate at which commercial banks receive financial funds from the central bank was raised to 3.75%, causing mortgage rates to rise to 4-5% p.a. This is the highest level on the market in the last 10 years. In early 2021, mortgages were being issued at less than 2%.

In the middle of last year, the Czech National Bank began to respond to rising inflation by raising interest rates. Already in December 2021, the base rate at which commercial banks receive financial funds from the central bank was raised to 3.75%, causing mortgage rates to rise to 4-5% p.a. This is the highest level on the market in the last 10 years. In early 2021, mortgages were being issued at less than 2%.

Mortgage rates are still significantly lower than inflation itself, which has reached a record 9.9% in January 2022, according to official data from the Czech Statistical Office. According to Filip Belant, head of mortgage lending at Česká spořitelna, a scenario where mortgages are issued at more than 6% p.a. is possible, but more likely is that they will be held at 5-6% p.a.

In spring, the Czech National Bank plans to tighten the conditions for obtaining a mortgage. Today you only need to have 10% of the property value to get one, but from April 2022 a minimum of 20% will be required.

Despite the significant increase in interest rates, the total volume of mortgages issued in 2021 approached the 430 billion Czech crowns mark, significantly exceeding the figures from previous years. In 2020, which until recently was considered a record year in terms of the total volume of mortgages issued, 173 billion crowns less was issued than in 2021.

Petr Dufek, an economist at ČSOB, notes that such high volumes of mortgages issued are also related to the growth in property prices. The growth in the total volume of mortgages issued is due not only to higher demand, but also to a higher average volume per mortgage.

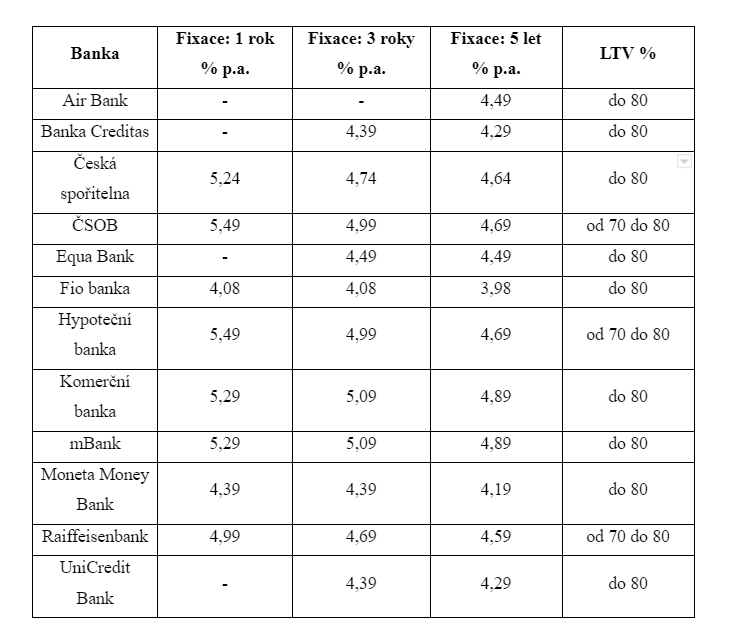

Fio banka offers the most favorable conditions on the mortgage market today. If the interest rate is fixed for 5 years, you can expect a mortgage with a rate starting from 3.98%. In the case of fixation for 1 or 3 years, the rate will be from 4.08%. Moneta Money Bank offers interest rates starting from 4.19% when fixed for 5 years.

If you are interested in purchasing a property, we will be happy to help you with the choice and arrange financing on the best terms.